Description

The Art of Reading Financial Statements – Practitioner Level course. Financial statements seem complicated and long, reading them requires judgment and practice, people don’t know where to start reading and what to look for, or people read financial statements linearly/sequentially without being able to even understand the main elements. There are red flags associated with it. to the company. This course aims to teach you the main reading keys for reading, understanding and digesting financial statements and financial reports. As Warren Buffett put it, if you want to be a better investor, you need to know the language of business, which is accounting: “You have to know accounting and understand the nuances of accounting. It’s the language of business, and it’s an imperfect one, but unless you’re willing to put in the effort to learn accounting—how to read and interpret financial statements—you really shouldn’t be picking stocks yourself. I approached writing this course by looking at what I had missed from my teachers and professors in my corporate accounting and finance classes. This course uses a different approach to reading financial statements and is able to quickly understand the nature of the company being analyzed. After completing the course you will be able to:

- Identify and understand the accounting standards used by IFRS, US GAAP, or local GAAP

- Distinguish between the 3 main types of financial statements (balance sheet, cash flow and profit and loss statement)

- Know the basic principles of accounting such as going concern, fair valuation, prudence principle, accrual versus cash accounting, etc.

- Understanding and identifying the main elements of corporate governance, including corporate governance of 1 or 2 layer models, the role of shareholders and the board of directors

- Understanding the role of the statutory auditor, the ability to recognize whether a report is audited or unaudited. In the event of an audit, identification of the statutory auditor, tenure of the statutory auditor, comments on the independence of the statutory auditor/conflict of interest/related fees and audit opinion.

- Understand the scope of consolidation (and non-consolidation) of the reporting company and 4 ways how subsidiaries can (or cannot) be consolidated in financial statements.

- Be able to analyze the balance sheet vertically and understand the main profitable assets as well as sources of capital on the balance sheet.

- Identifying sources of capital including long-term debt and its related plan, long-term debt service cost including interest coverage ratio, source of equity capital including potential accumulated profit

- Deep understanding of shareholder value creation by understanding ROIC and WACC

- Understanding the profitability of the company by analyzing revenue segments (if any) and cash generating assets, understanding operating cash flow and working capital versus financing and investing cash flows

- Be able to read earnings information including EPS, NOPAT, EBITDA, EBIT and net income

This course also includes lots of practical examples like all my courses. We will practice and discuss the financials of companies such as Kelloggs, Mercedes, Telefonica, 3M, Evergrande, Alphabet, Meta, Microsoft, Unilever, Wells Fargo, Wirecard, CostCo and many others. At the end of the tutorial, I will show you the complete process of how to read the financial statements of 3 companies (Vonovia, Qurate, Skywest Airlines) so that you can see exactly and hopefully understand the nature of the companies that are not. Known to me at first. Last but not least, adult education without practice, knowledge checks and homework is just fun. For this reason, this course contains more than 10 assignments for you to practice as assignments and share them with me after completion for review if you wish. We wish you success in this tutorial and we hope that it will help you grow to Become an investor, analyst or company professional. Thank you again for choosing my field

What you will learn in The Art of Reading Financial Statements – Practitioner Level course

-

Create a source of information and download the latest financial report and identify the accounting standards used IFRS, US GAAP or local GAAP

-

Understanding and identifying the main elements of corporate governance: determining corporate governance model 1 or 2 layers and external regulations

-

Understanding the role of the statutory auditor, audit status, identification of the statutory auditor, tenure of the statutory auditor and audit opinion

-

Understand the scope of consolidation (and non-consolidation) of the company

-

Be able to analyze the balance sheet vertically and understand the significant assets and liabilities on the balance sheet.

-

Identify sources of capital including long-term debt, related schedule, long-term debt service cost including interest coverage ratio, source of equity capital

-

Deep understanding of shareholder value creation by understanding ROIC and WACC

-

Understanding company profitability by analyzing revenue segments and cash-generating assets, understanding operating cash flow and working capital versus other cash flows

-

Be able to read earnings information including EPS, NOPAT, EBITDA, EBIT and net income

This course is suitable for people who

- Accounting and finance students

- Investors value

- People interested in financial affairs and company financial statements

- Financial analysts

- Business evaluators

- accountants

- Corporate officers

- Anyone interested in analyzing and investing in companies

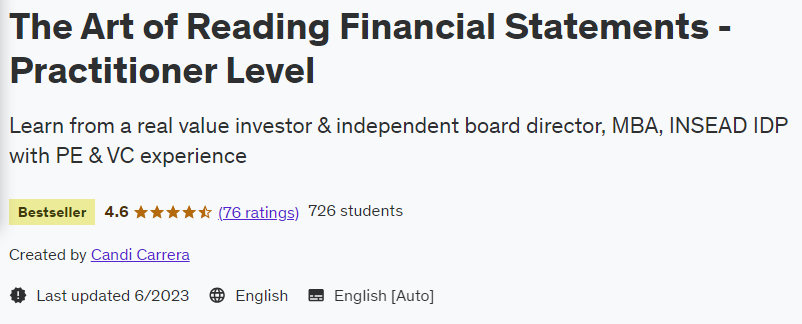

Course specifications The Art of Reading Financial Statements – Practitioner Level

- Publisher: Udemy

- teacher: Candi Carrera

- Training level: beginner to advanced

- Training duration: 15 hours and 43 minutes

- Number of courses: 25

Course topics on 6/2023

Prerequisites of The Art of Reading Financial Statements – Practitioner Level course

- Being interested in companies

- Have a minimal knowledge of how companies & business in general works

- Wanting to learn how to read financial statements

Course images

Sample video of the course

Installation guide

After Extract, view with your favorite Player.

Subtitle: None

Quality: 720p

download link

File(s) password: www.downloadly.ir

Size

11.5 GB