Description

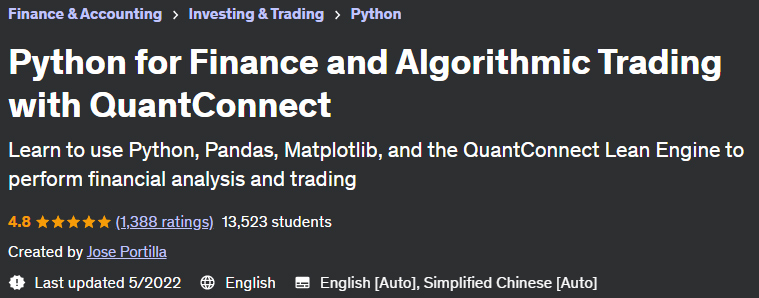

Python for Finance and Algorithmic Trading with QuantConnect The training course on making smart robots for trading and analyzing financial markets with Python programming language is published by Udemy Academy. In this course, you will use Pandas and Matplotlib libraries to develop a fully intelligent and algorithmic trading and analysis system. At the end, you will load your trading robot on the powerful QuantConnect platform and start trading. QuantConnect is an open-source, cloud-based platform that helps engineers and programmers develop their own strategies in the form of code and automated bots, and then execute their desired algorithmic trades. This trading platform provides traders with a variety of symbols and markets, the most important of which are options, forex, futures, crypto, and the American stock market.

Python is a high-level and very popular language that has been used in the design of systems based on artificial intelligence and machine learning, and in this regard, this language has also opened its doors to financial markets. In this training course, you will get to know the principles and concepts of economics and trading very carefully, and then you will be able to convert these principles into code. All topics taught in this course are implemented in a practical way and at the end of this course you will gain valuable knowledge in the field of financial markets, trading strategies, algorithmic trading, etc.

What you will learn in the Python for Finance and Algorithmic Trading with QuantConnect course:

- Getting to know the basics of the Python programming language

- Working with the NumPy library to perform fast numerical operations

- Working with the Pandas library in order to quickly and effectively analyze various data

- Working with the Matplotlib library to visualize data and display raw and numerical data in the form of various charts and graphs

- Detailed analysis of stock returns and annual profits

- Computing Cumulative daily returns

- Analysis of volatility and risk potential of each market

- Working with the EWMA moving average

- Getting to know the Sharpe ratio

- Optimization Portfolio and the allocated capital of each symbol and market

- Getting to know the efficient frontier theory

- Different types of funds and tradable symbols

- Methods of placing orders and determining profit and loss limits

- Capital asset pricing model

- Familiarity with options and futures transactions

- Getting to know the Monte Carlo calculation method

- Complete familiarity with financial market terms such as income, profit on shares, etc.

- Working with the Bollinger Band indicator and other available indicators and oscillators

- Familiarity with classic technical analysis

Course details

Publisher: Yudmi

teacher: Jose Portilla

English language

Training level: introductory to advanced

Number of courses: 135

Training duration: 22 hours and 50 minutes

Course headings

Python for Finance and Algorithmic Trading with QuantConnect course prerequisites

Basic Python Experience

Course images

Python for Finance and Algorithmic Trading with QuantConnect course introduction video

Installation guide

After Extract, view with your favorite Player.

English subtitle

Quality: 720p

Changes:

The version of 2022/5 compared to 2021/9 has increased the number of 2 lessons and the duration of 16 minutes.

download link

Password file(s): www.downloadly.ir

Size

6.11 GB