Description

Banking Credit Analysis Process Course (for Bankers). Do you understand the topics related to bank credit such as financial ratio analysis, cash flow and funds flow analysis, evaluation of working capital and products such as cash credit, letter of credit, bank guarantee, buyer’s credit, term loan evaluation that analysis And covers equity analysis, DSCR, have issues, FOIR etc.? Are you a finance professional working on project financing for your clients? Is it difficult for you to write a comprehensive loan proposal? Are you a banker who wants to rise to the top in your career? Then this course is for you – The Bank Credit Analysis Process. Why should you take this course?

- Credit analysis is the main process adopted by any bank to understand, evaluate and appreciate customers’ identity, honesty, financial position, – repayment capacity etc.

- Every banker should go through the process of credit analysis thoroughly because he has to deal with new customers every day and before sanctioning any new loan to them, the banker should do due diligence on his customers.

- No banker can reach the top unless he is familiar with the process of credit analysis.

- Banks usually hire employees before they have had a chance to train. This is with more specific reference to credit analysis where bankers have to go through a rigorous learning process, otherwise their mistakes in this very costly process will be beyond their controllable position.

- Hence, this course provides a platform for bankers to address the critical aspects of the credit analysis process. Banking/Management Consultants can also use this course to equip themselves with bankers’ expectations while handling credit proposals.

- By completing this course, you will be able to write bank loan proposals with greater clarity and confidence.

- You will understand the various technical issues that are written in the bank loan proposals.

What will you learn by participating in this course?

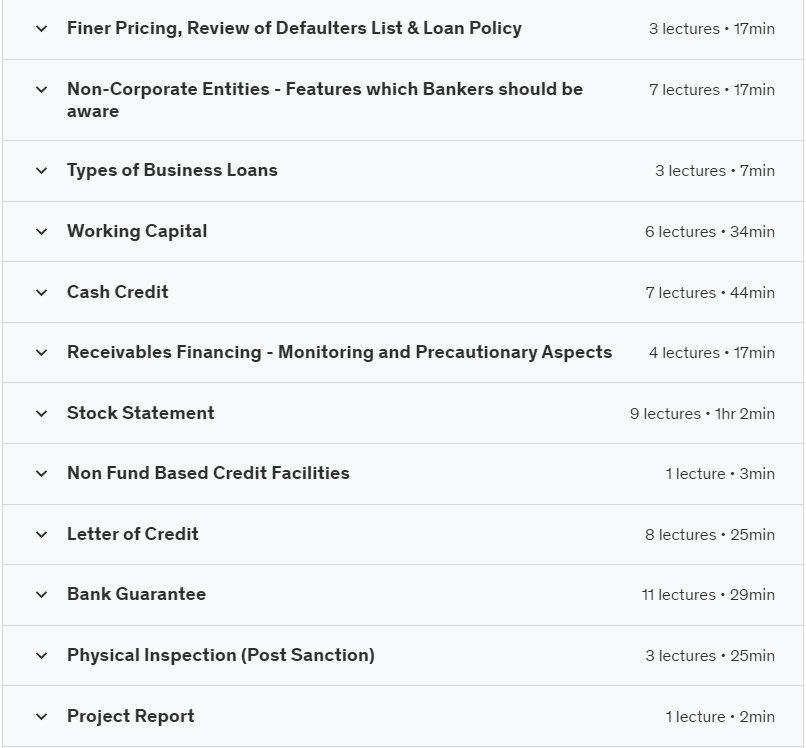

- Part 1 – Introduction to credit analysis

- Part 2 – Financial statement reading skills

- Section 3 – How to write a loan proposal – Introduction

- Section 4 – Financial ratio analysis

- Section 5 – Performance analysis and financial indicators in the loan proposal

- Section 6 – Fund flow analysis to identify diversion of funds

- Section 7 – Cash flow analysis to understand the generation and movement of cash

- Section 8 – Inter-Company Comparison, Internal and External Ratings and Account Behavior Review

- Section 9 – Review of audit reports, compliance, contingencies and risk factors

- Section 10 – More accurate pricing, delinquent list checks and loan policies

- Section 11 – Types of commercial loans

- Section 12 – Working capital

- Section 13 – Cash Credit

- Section 14 – Non-fund-based credit facilities

- Section 15 – Letter of credit

- Section 16 – Bank guarantee

- Section 17 – Project report

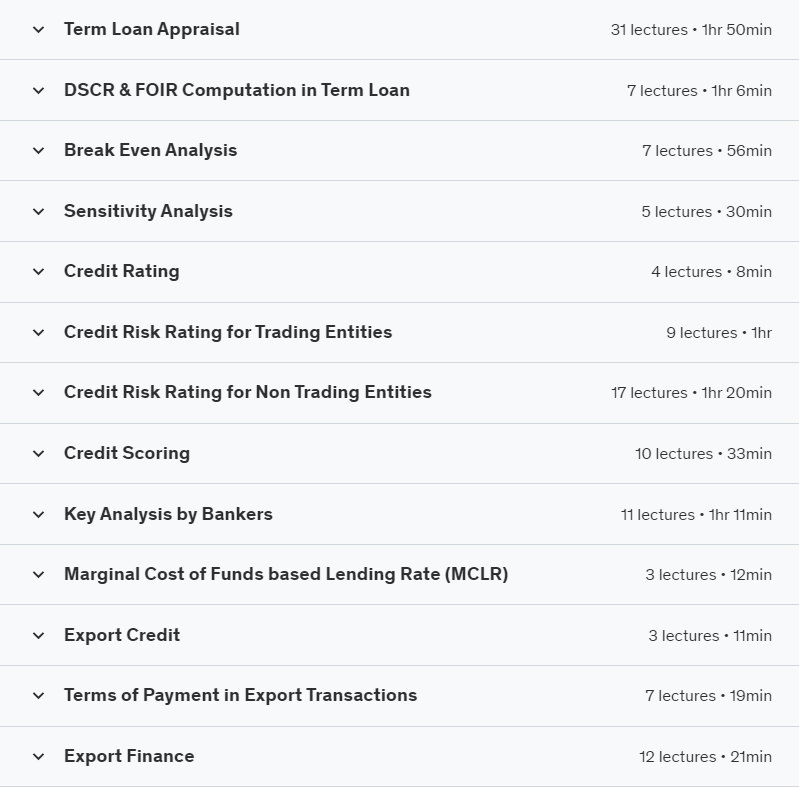

- Section 18 – Evaluation of loan term

- Section 19 – Calculation of DSCR and FOIR in term loan

- Section 20 – Uniform analysis

- Section 21 – Sensitivity analysis

- Section 22 – Credit Rating

- Section 23 – Credit Scoring

- Section 24 – Key analysis by bankers

- Section 25 – Marginal Cost of Funds Based Lending Rate (MCLR)

- Section 26 – Export credit

- Section 27 – Terms of payment in export transactions

- Section 28 – Export finance

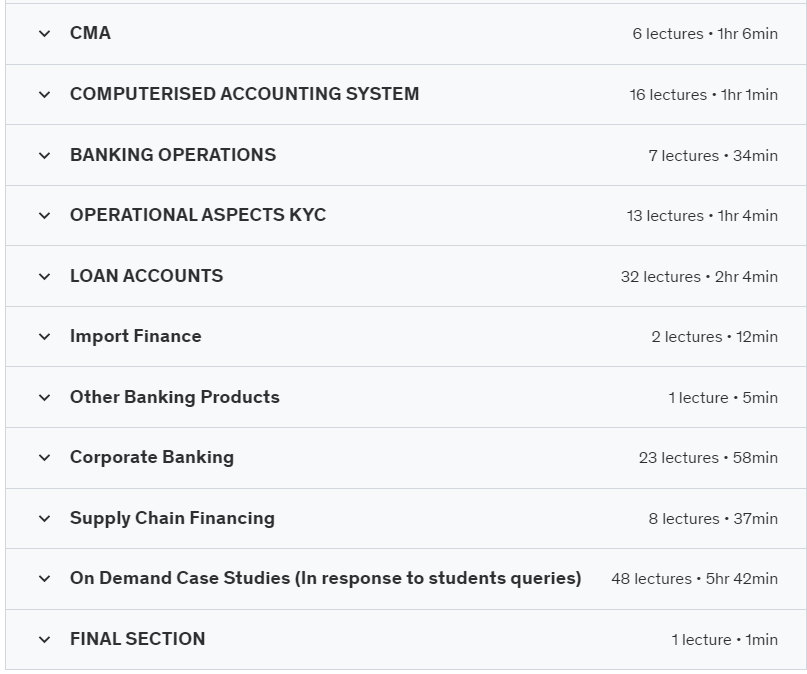

- Section 29 – CMA (Credit Monitoring Arrangement)

- Section 30 – Computerized accounting system

- Section 31 – Banking operations

- Section 32 – Operational Aspects of KYC

- Section 33 – Loan accounts

- Section 34 – Examination

- Section 35 – Import finance

- Section 36- Other banking products

What is the structure of this course? This course is designed in a self-paced learning style. Each part of this course is separated into different micro-lectures and then proven with examples and case studies. Several real-world examples are used in this course through case studies. As I take you through the lectures one by one, you’ll gain authority on any topic. This course is presented in simple language with examples. This course has visual lectures (with writing on blackboard/greenboard/notebook/talking head etc.). You feel like you are attending a real class. How will this course benefit you? At the end of the course, you will be able to deal with credit matters in your bank with high confidence and solve real life problems easily.

What you will learn in the Banking Credit Analysis Process (for Bankers) course

-

Understand what credit analysis is

-

How to evaluate the credit proposal

-

How to analyze financial statements

-

How to analyze term loan projects

-

Understanding what project financing is

-

How to get working capital

-

What is the working capital cycle?

-

What is a letter of credit?

-

What is a bank guarantee?

-

Understand the detailed credit analysis process

This course is suitable for people who

- Bankers

- Consultants (management/bank/finance)

- Financial managers

- Entrepreneurs looking for capital

- Heads or managers of units

- Certified accountants

- Cost accountants

- DSA Bank

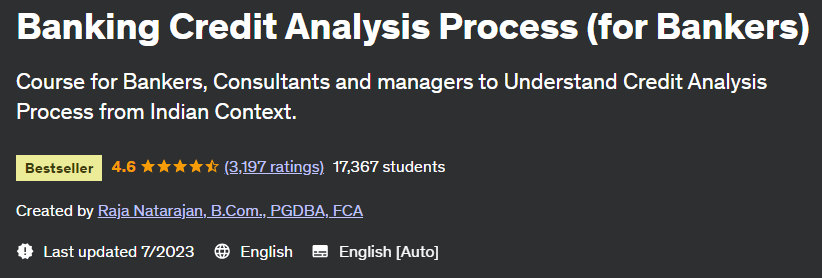

Details of the Banking Credit Analysis Process (for Bankers) course

- Publisher: Udemy

- teacher: Raja Natarajan

- Training level: beginner to advanced

- Training duration: 44 hours and 13 minutes

- Number of courses: 474

Course headings

Banking Credit Analysis Process (for Bankers) course prerequisites

- No prior knowledge is required for taking this course.

- Students need PC / Laptop / Tab / Mobile (supporting Android / iOS) to view this course

Images of the Banking Credit Analysis Process (for Bankers) course

Sample video of the course

Installation guide

After Extract, view with your favorite Player.

English subtitle

Quality: 720p

download link

File(s) password: www.downloadly.ir

Size

14.5 GB