Description

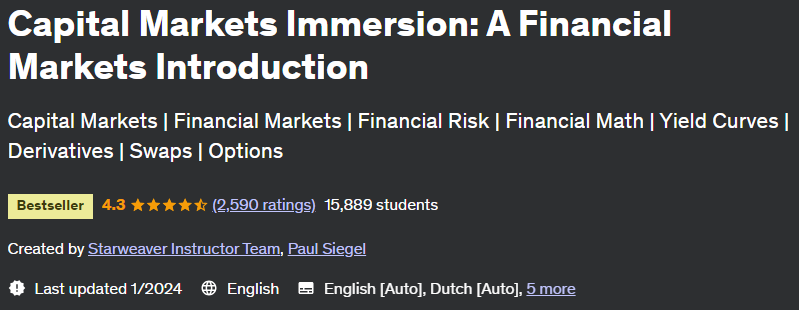

Capital Markets Immersion Course: A Financial Markets Introduction. The Immersion Period of Capital Markets: An Introduction to Financial Markets. The Capital Markets Immersion: Introduction to Financial Markets program provides a solid and in-depth introduction to global financial markets and capital markets. This course is designed to provide an in-depth and comprehensive study of the functions and roles played by modern financial institutions and their key lines of business. This program is intended for professionals (or those about to enter the business) with a basic knowledge of the industry’s essential products and services and how each works. You don’t need to know what a commercial or investment bank is, or how interest rates work to price bond (fixed income) products. But, after completing this course, you can easily talk about the industry and its products and services both from a bird’s eye view and from the ground level. This is the most comprehensive course on capital markets on Udemy. The framework of this program consists of lectures covering 7 separate topics:

1. Roadmap of capital markets – the main participants, issuers, investors, intermediaries in the capital markets, what they trade there and the uses for which market participants use the tools and roles they play. highlights

2. Fundamental financial mathematics – introduces you to a wide range of calculations and related concepts used by financial market participants in a multitude of applications – for example calculating prices, rates of return, and returns.

3. Yield Curve Dynamics – Covers various topics related to yield curves, their construction, and their use in a variety of analytical programs to assess risk and return.

4. Fixed Income Securities – Introduces you to the fixed income securities market, giving you a lot of detail about the characteristics of fixed income securities in general, as well as the specific characteristics of specific market segments. Discusses fixed income – insurers. investors, and a wide range of concepts related to the analysis and validation of those securities.

5. Stock Products – Introduces stocks by providing an overview of product types, including direct and indirect products. and showing the types of stocks and exchanges, investors, diversity and volatility.

6. Futures and Options – Introduces derivatives in general to show the common features of derivatives and how they differ from other types of financial instruments. Key features of futures and options contracts will be identified, and contract features, pricing, applications, risk management, and hedging will be discussed.

7. Interest Rate Swaps – A look at interest rate swaps in detail. First, swaps are introduced in general, then the structure of the most common type of interest rate swap – fixed or floating interest rate swap – is discussed. A variety of different structures, pricing and valuation, and applications – both risk management and speculative – will be discussed.

happy learning

What you will learn in the Capital Markets Immersion: A Financial Markets Introduction course

-

Apply key financial math skills, including NPV, IRR, PV, FV, to real business problems.

-

Discuss the players, products, markets and applications of capital market instruments.

-

Interpret the meaning of yield curves and how markets and financial instruments drive pricing.

-

Explain the full range of fixed income instruments, their issuers and investors, and how these instruments are structured.

-

The stock market details the products, players and market dynamics.

-

Determination of uses and future uses and powers.

-

Become a good financial markets and capital market expert

This course is suitable for people who

- Analysts and associates in commercial, corporate and investment banking.

- Relationship Managers (0-5 years) in commercial, corporate and investment banking.

- Students who are new to the financial services business and are looking for a complete picture of the capital markets and how they work

Description of the Capital Markets Immersion: A Financial Markets Introduction course

Course topics on 1/2024

Capital Markets Immersion: A Financial Markets Introduction course prerequisites

- Knowledge of the English language.

- Basic math knowledge (a calculator is recommended for some of the lectures).

Course images

Sample video of the course

Installation guide

After Extract, view with your favorite Player.

English subtitle

Quality: 1080p

download link

File(s) password: www.downloadly.ir

Size

29.1 GB