Description

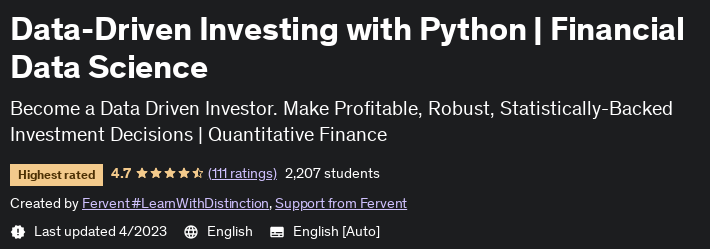

Data-Driven Investing with Python Financial Data Science, a data-driven investment training course with Python, is published by Udemy Academy. Become a data-driven investor. Take the guesswork out of your investing forever. Leverage the power of financial data science, financial analytics, Python, and quantitative finance for strong investment decisions (and alpha generation). Discover how to use rigorous statistical techniques in Python to guide your investment decisions (even if you don’t know statistics or your math is weak).

To gain a solid foundation, you start with the principles that cover the entire process of investment analysis and financial analysis. Take your investment and financial analysis skills to a whole new level by learning how to use financial data science, quantitative finance, and Python to invest. We have used the same trial and error techniques that have been proven to help our clients pass their professional exams as well as get hired by the most prestigious investment banks in the world, manage their portfolios, Take control of your finances, overcome your fear of math and equations, and much more.

What you will learn

- Take the “guesswork” out of your investing forever by learning how to statistically test and rigorously validate your investment ideas in Python.

- Discover and master the systematic and scientific process of data-driven investing that will change the way investments are analyzed forever

- Apply everything you learn using rich, big data from the real world (without compromising the mathematical and theoretical integrity of the concepts).

- Learn how to use incredibly powerful relationships and sophisticated financial data science techniques in Python to generate alpha.

- Understand how math relationships work (and why equations work the way they do)—even if your math is weak.

- Explore evergreen concepts such as expected returns, asset pricing models and portfolio construction in unique financial data science environments, using Pandas

Who is this course suitable for?

- Individual or non-commercial investors looking to “upgrade” their financial analysis skills using the power of financial data science and Python.

- Fund analysts and colleagues are boldly looking to master quantitative finance techniques in Python

- Portfolio managers who want to move from subjective decision making to robust data-driven investment analysis techniques in Python rooted in academic and professional research.

Details of the Data-Driven Investing with Python course Financial Data Science

Head of the course seasons on 2023-4

Course prerequisites

- No prior finance or investing knowledge required. We start from the very basics. And transform you into a robust Data Driven Investor.

- Basic coding knowledge is REQUIRED. You don’t need to be an ‘expert’ in Python, but you do need to know the basics (eg, difference between strings, floats, lists, dictionaries)

- It’s okay if math freaks you out. Seriously. Every single equation is explained one variable at a time. We rip it apart to its core, and show you how simple it really is.

- Knowledge of basic statistical analysis is useful but NOT essential. Every relevant statistical test is taught from scratch.

- You’ll need a calculator, pen and paper (seriously), and your development environment (eg Jupyter Notebooks, Text Editors)

- We work with Jupyter Notebooks in the course, but .py versions of all Python code are available for download.

Pictures

Sample video

Installation guide

After Extract, view with your favorite Player.

English subtitle

Quality: 720p

download link

File(s) password: www.downloadly.ir

Size

3.21 GB