Description

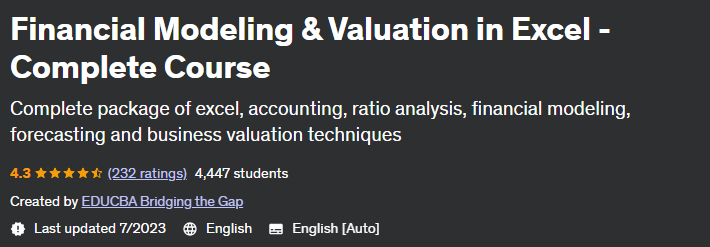

Financial Modeling & Valuation in Excel – Complete Course, the financial modeling and valuation training course in Excel has been published by Udemy Academy. Financial modeling is a technique used by companies for financial analysis in which a company’s income statement, balance sheet, and cash flow statement are projected for the next five to ten years. This work includes the preparation of detailed Excel models for the company, which are then used to make decisions and perform financial analysis. It is nothing but creating a financial representation of some or all aspects of the company. In other words, the company is preparing expected financial statements to predict the company’s financial performance in the future period using assumptions and historical performance information. Such financial models can be used in DCF valuation, mergers and acquisitions, private equity, project finance, etc.

This course is a comprehensive set of Excel, valuation, accounting, financial analysis and financial modeling. This course is suitable for people who are interested in the job of financial analyst and finance. Many students and professionals think that if they are not from a top-tier college, their chances of landing a job as an analyst in the financial industry are poor. However, we have seen a trend where skilled students and professionals from lesser-known universities and companies are transitioning to major financial firms and organizations. Universities are very limited in their curriculum as they are more limited to focus on theoretical aspects rather than actual practical knowledge. Financial analyst training includes detailed financial analysis of companies. The analysis is conducted through a combination of financial records, news and interviews with internal company employees.

What you will learn

- Excel shortcuts, formulas, formatting, number formatting and many other financial functions and Excel features

- Financial modeling from scratch

- You will understand valuation techniques from scratch in a financial model.

- Able to make a cash flow statement

- You can build an evaluation model from scratch

- This tutorial is dedicated to learning about the most common DCF valuation techniques.

- Fundamental analysis, company valuation, financial ratio analysis, financial statement forecasting, industry analysis

Who is this course suitable for?

- This course is particularly useful for those who develop financial models as part of their career.

- From investment bankers to financial analysts, most financial professionals will find great information in this course.

- Students who studied finance and want to work in the field of financial modeling.

- Graduate students who aspire to work in venture capital firms, financial advisory professionals, consultants

Details of the Financial Modeling & Valuation in Excel course – Complete Course

- Publisher: Udemy

- teacher : EDUCBA Bridging the Gap

- English language

- Education level: all levels

- Number of courses: 256

- Training duration: 33 hours and 31 minutes

Head of the course seasons on 2023-7

Course prerequisites

- To get the best from this financial modeling certification course, you need to practice what you learn. Since it’s a comprehensive course, you need to look at each module again and again and apply what you learn.

- Microsoft Excel 2010, 2013, 2016, 2020, or Microsoft Excel 365

Pictures

Sample video

Installation guide

After Extract, view with your favorite Player.

Subtitle: None

Quality: 720p

download link

File(s) password: www.downloadly.ir

Size

18.45 GB