Description

The Art of Value Investing course – Complete course. This course combines over 20 years of experience and learning as a value investor. You will learn the financial fundamentals of the stock market, money and inflation to find great companies at cheap prices. As Warren Buffett said, you don’t need a PhD to become a good investor. This requires the mindset of a business owner, not a speculator. This course will teach you how to determine the intrinsic value of a company against its current stock price and also help you judge whether the company has strong financial fundamentals. Unique Content: In the last part of this course, and as part of my ongoing research as a value investor for over 20 years, I will provide unique features on how to evaluate moat companies with only a few investors. I will share with you. Use as well as how to capture customer and employee sentiments about a company. The purpose of this training is to make you a seasoned investor and develop the right investment mindset while giving you the key to reading company financial statements and growing your wealth. I will teach you the basics of how to read financial statements such as 10-K, 10-Q reports. After this course you will be equipped with a series of tests to understand the financial strength of a company. Learn the art of value investing and excel. Investing in stocks and acting as a business owner can be a life-changing experience. Benefit from my 20 years of experience as an investor running your own mutual fund and move forward faster with the knowledge I will share with you.

What you will learn in The Art of Value Investing – Complete course

-

Have a good understanding of how to find good stocks and how to invest in those companies

-

Be able to determine the intrinsic/real value of a company

-

Before investing in the stock market, apply key value investing strategies

-

Make better investment choices with your money with the right investment mentality

-

Be able to differentiate between good and bad stocks

-

Create a stream of passive income with your stocks

-

Evaluating the profitability of the company with the ratio of return on equity, return on invested capital and net return on tangible assets (ROE, ROIC, RONTA)

-

Evaluate the company’s price-to-earnings (P/E) ratio and other key ratios

-

Determining the company’s capacity to repay the debt

-

Have a repeatable investment process

-

Learn how investors like Warren Buffett, Benjamin Graham, Charlie Munger or Peter Lynch became rich and successful.

-

Able to use valuation methods such as book value, balance sheet revaluation, dividend models, discounted cash flow and discounted future earnings models.

This course is suitable for people who

- People who want to invest safely in the stock market

- People looking for passive income

- People who want to increase their wealth

- People who do not know how to safely invest in the stock market

- People who want to learn the methods of Warren Buffett and Benjamin Graham

- People who want to change their lifestyle and spend more time with their family, friends and loved ones

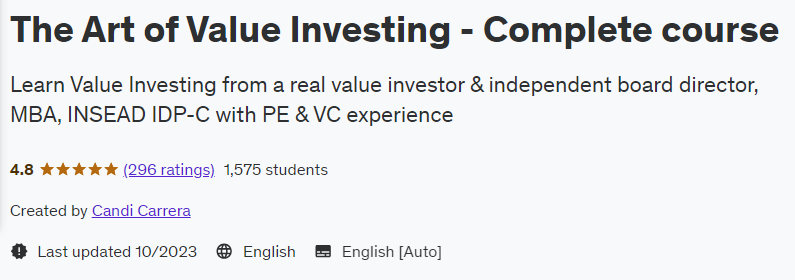

Details of The Art of Value Investing – Complete course

- Publisher: Udemy

- teacher: Candi Carrera

- Training level: beginner to advanced

- Training duration: 9 hours and 43 minutes

- Number of courses: 29

Course topics on 10/2023

Prerequisites of The Art of Value Investing – Complete course

- Willingness to become a real investor like Warren Buffett, Benjamin Graham or Charlie Munger

- Having a basic understanding of businesses and how companies work

- No further prerequisites needed although good to know your long-term investment & wealth goals

Course images

Sample video of the course

Installation guide

After Extract, view with your favorite Player.

English subtitle

Quality: 720p

download link

File(s) password: www.downloadly.ir

Size

8.4 GB