Description

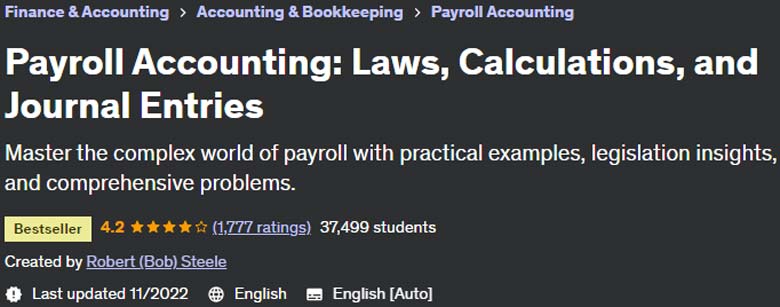

Payroll Accounting: Laws, Calculations, and Journal Entries is a payroll accounting training course published by Yodemy Online Academy. Payroll accounting refers to the process of calculating and managing the compensation of an organization’s employees, including wages, salaries, bonuses, and deductions. This includes recording financial transactions related to employee compensation, complying with tax regulations and ensuring accurate and timely payments to employees. Payroll accounting is an important function for businesses of all sizes because it directly affects employees and has legal and financial implications. In this training course, you will get to know the law and its calculation techniques and you will understand the concepts of its basic principles. In this training course, you will learn about many laws that affect payroll operations.

Knowledge of tax laws and the use of technology to simplify processes and ensure accuracy are among the goals you will achieve in this training course. One key aspect that is often overlooked in payroll processes is the recording of payroll transactions. In this course, you will thoroughly learn about payroll journal entries and gain a comprehensive understanding of their complexity. This course is recommended for accounting professionals who want to expand their knowledge and skills in payroll accounting and small business owners with payroll responsibilities. After completing this training course, you will have high knowledge and skills in payroll accounting and you will be familiar with its rules and principles.

What you will learn in the Payroll Accounting: Laws, Calculations, and Journal Entries training course:

- Key salary rules and regulations

- Appropriate formulas to determine employer and employee social security contributions

- The use of salary concepts in the framework of the accounting cycle

- Familiarity with payroll tax forms

- Various salary deductions

- And …

Course details

Publisher: Yudmi

teacher: Robert (Bob) Steele

English language

Education level: Intermediate

Number of courses: 208

Training duration: 20 hours and 29 minutes

Course headings

Prerequisites for the course Payroll Accounting: Laws, Calculations, and Journal Entries

There are no specific prerequisites for this course. However, a basic understanding of accounting principles and concepts would be beneficial. Familiarity with financial statements, general ledger, and basic mathematical calculations will also be helpful in grasping the payroll concepts covered in the course.

Course images

Payroll Accounting: Laws, Calculations, and Journal Entries introduction video

Installation guide

After Extract, view with your favorite Player.

English subtitle

Quality: 720p

download link

Password file(s): www.downloadly.ir

Size

20.9 GB